License‑Level Demand Forecasting for Spencer’s & Spirit Halloween

About

Spencer Gifts LLC, a leading specialty retailer founded in 1947 and headquartered in Egg Harbor Township, New Jersey, operates two iconic brands: Spencer’s, a lifestyle retail chain with over 680 stores across the U.S. and Canada and a fast-growing e-commerce business known for edgy pop-culture-inspired products; and Spirit Halloween, the world’s largest Halloween retailer, running over 1,530 big‑box pop‑up stores from August through October in addition to a year‑round online store.

Both brands thrive on staying ahead of rapidly shifting pop‑culture and seasonal trends. Their merchandising strategy relies on exclusive licenses and limited‑run products that resonate strongly with Gen‑Z and Millennial shoppers.

Objective

Spencer’s merchandising and planning teams asked: “How can we reliably forecast demand for licensed merchandise, so we place the right inventory in the right stores without losing sales to stock‑outs or tying up capital in overstocks that end up on clearance?”

Because many licenses are trend‑driven while others have enduring appeal, a one‑size‑fits‑all forecasting approach produced wild swings in accuracy. The business needed a data‑driven method that captured both rapid fad cycles and steady, seasonal patterns at the SKU‑license level.

Approach

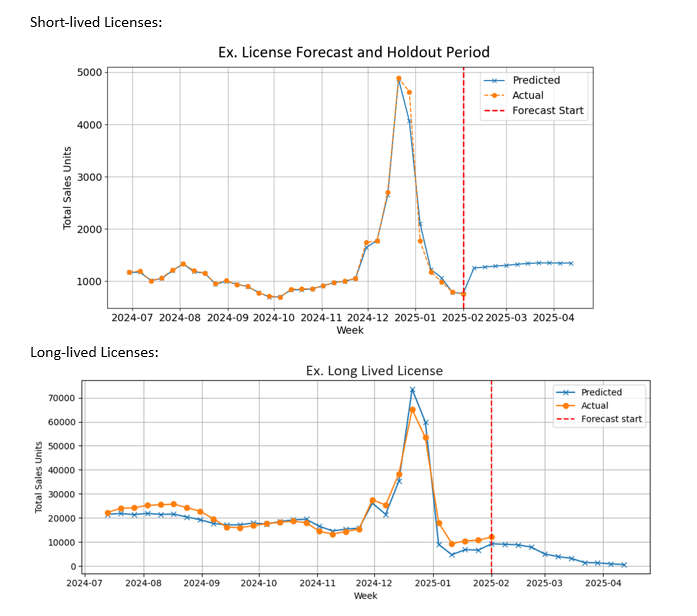

Our team ingested three years of weekly sales, pricing, and inventory data across licenses, supplemented with Google search‑trend indices, holiday flags, and product metadata. Exploratory analysis revealed two distinct behaviors: short‑lived licenses that exhibit high initial spikes then taper off, and long‑lived licenses that show repeatable holiday peaks and solid baseline sales.

We therefore developed a two‑stage pipeline:

- License‑Life Classification, a gradient‑boosting classifier predicts whether a license is short‑ or long‑lived using features such as total units sold, holiday share, catalog breadth with an overall accuracy ≈ 80 %.

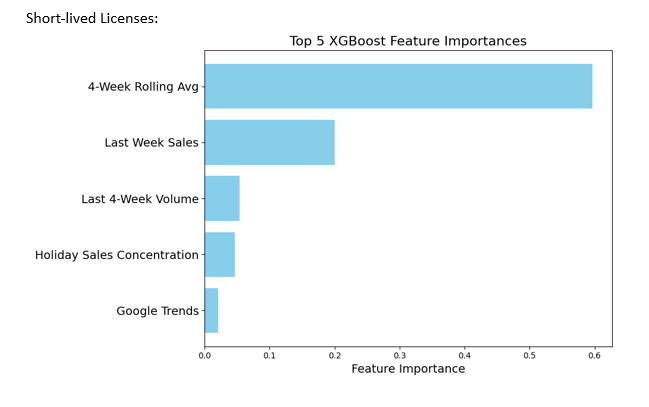

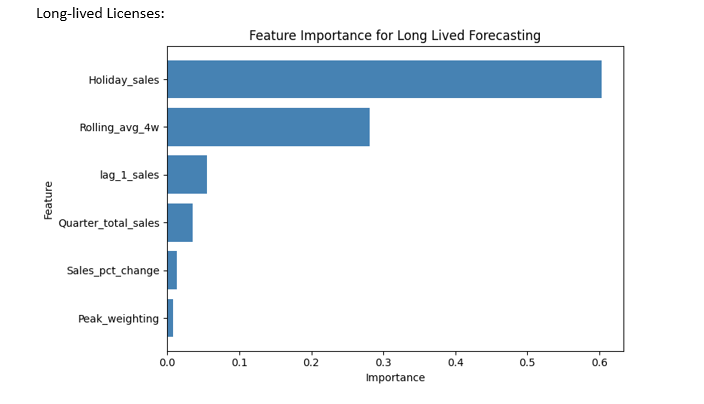

- Segment‑Specific Forecast Models, separate LightGBM regression models forecast 26‑week unit sales for each segment. Key features for the short‑lived model included recent weekly velocity, change in velocity, holiday concentration, and Google trends; the long‑lived model leaned more on rolling averages, prior‑year holiday lifts, and outlier flags.

We iterated through hyper‑parameter tuning and back‑testing, holding out the latest season as a blind test set.

Solution

The final solution delivers a license‑level 26‑week demand forecast with the following performance:

- Short‑lived licenses: average MAPE = 9.8 %; 80 % of licenses within ±15 %.

- Long‑lived licenses: average MAPE = 3.4 %; 80 % of licenses within ±4 %.

Next‑step recommendations include integrating social‑media sentiment feeds, refining store‑level disaggregation, A/B‑testing automated buy‑quantity overrides during the 2025 Halloween season, and updating these models in a PowerBI dashboard that is scheduled to retrain monthly, quarterly, and annually to incorporate the latest sales and trend signals automatically.

Impact

Spencer’s projects that a 5–10 percentage‑point improvement in forecast accuracy will translate into incremental gross margin through fewer lost sales and reduced end‑of‑season markdowns. Better inventory alignment also lowers costs.

Beyond the immediate financial benefit, the forecasting framework gives Spencer’s a repeatable template for rapidly assessing new pop‑culture licenses, helping merchants capitalize on emerging trends and reduced inventory at markdown.

About the AI & Analytics Accelerator

The AI & Analytics Accelerator, part of the Wharton AI & Analytics Initiative, partners with organizations to develop cutting-edge AI and data-driven solutions for real-world challenges. Through collaboration with Wharton faculty, researchers, and students, the Accelerator transforms complex data into actionable insights, driving innovation across industries.